Martin's Mortgage Maneuver: Part Two

Refinancing your mortgage to create low-risk, passive income

Sign up for my NEWSLETTER HERE

With Martin’s Mortgage Maneuver, I explained how I blended-and-extended my mortgage before breaking it. This simple step allowed me to reduce my mortgage Prepayment Charge from $28,000 to $3,000. With this lower Prepayment Charge, I was able to refinance my mortgage: moving from a 2.49% five-year, fixed-rate mortgage to a 1.74% five-year, fixed-rate mortgage. After paying all refinancing fees, the net savings to my family was roughly $10,000 in after-tax income. So well worth it from our perspective.

When we refinanced, it also created an opportunity to withdraw equity from our home at the same 1.74% interest rate. For illustrative purposes, I’m going to use a scenario where we withdrew $150,000 (not our exact situation). My wife and I then invested that $150,000 in our TFSA’s, which we’d emptied out to buy our home in 2019. $150,000 is likely a relevant number to many people. If you were: (i) 18 years old in 2009; and (ii) have never contributed to your TFSA, then you have $75,500 in TFSA contribution room. If you have a spouse in the same situation, then your family has $151,000 in TFSA contribution room. I’ve rounded it down to $150,000.

So, we now have a mortgage that is $150,000 larger than it would have been had we not taken out the equity from our home. However, offsetting that larger mortgage is an extra $150,000 that we now have in our TFSA’s (instead of $0). The net effect is that we took out a $150,000 investment loan that was added to our mortgage at an interest rate of 1.74%. To put this “investment loan” into perspective, if you walked into a bank and asked to borrow money to invest you’d be charged at least 5.00%.

While the idea of borrowing money to invest may sound risky and a heck of a lot like gambling I hope to demonstrate that, if the money is invested conservatively, it is low risk with a very high prospect of improving your long-term financial position. To be clear, I’m not saying there is no risk. There’s always risk when you invest in the markets.

Moving back to my mortgage investment loan, in the current low-rate environment I expect that this $150,000 investment loan: (i) won’t cost me a penny of my own money to finance over the next five years, (ii) will help me build equity, and (iii) will increase my future TFSA contribution room.

Before I get into the details, I want to remind you that I’m not giving you financial advice. I’m not telling you to do this. You may read this and decide “nope, not for me”. That’s fine. But perhaps you’ll read this and decide it makes sense for you too.

My Background

First, a bit about my financial circumstances. I’m married and have two young kids in daycare. While we’re doing fine, these are expensive years … daycare alone costs $25,000 in after-tax income. Given our current cash flow situation, over the next five years we’ll likely struggle to contribute the $6,000 in new TFSA contribution room that we get from the government each year ($12,000 in total per year). We’d certainly have had no prospect of saving the $150,000 needed to replenish our TFSAs. So, without this $150,000 loan, we would have been sitting on a huge amount of unused TFSA contribution space. I’ll explain below why that’s a horrible thing to do, if you can avoid it.

Martin’s Mortgage Maneuver: Part Two

So, we borrowed $150,000 and we invested it in our TFSA’s. Sounds risky right?

No. Not really. We allocated that money to a diversified portfolio of dividend paying stocks. Specifically, we allocated the entire amount to an exchange-traded fund (ETF) offered by iShares called XEI. XEI holds roughly 70 higher-yielding, dividend-paying stocks that are listed on the Toronto stock exchange. It’s mostly made up of boring, mature companies with consistent cash flow like: banks, utilities, pipelines, telecoms, etc. You’re never going to “ride it to the moon” a la Game Stop owning these stocks, but you will receive regular dividends that are unlikely to be cut and far more likely to increase over time.

At the time I started writing this XEI traded for roughly $20.50 per share. Every single month each share of XEI pays out a dividend of roughly $0.085. There’s some variability in the monthly payout, but for years-on-end the monthly payout has been between $0.075 per month and $0.091 per share. The average is $0.085 per month, per share. The overwhelming majority of these payments are sourced from dividends paid from the underlying 70 holdings. Roughly speaking we are talking about a dividend yield of 5%.

So my loan, which is financed at 1.74% per year, generates tax-free cash flow at a rate of 5.00% per year. That alone should arouse your interest. Whenever you can generate tax-free income at a rate that is higher than the after-tax cost of borrowing you are well-positioned to make money.

The XEI Distributions are Used to Pay my Mortgage Payments

With $150,000 we bought 7,300 shares of XEI. These shares generate monthly, tax-free income of $620.50 per month, or just under $7,500 per year.

The monthly nature of the distribution is important because mortgages are also paid on a monthly basis.

Now remember, this $150,000 investment loan was added to our mortgage at a rate of 1.74%. Using a handy mortgage payment calculator, you can see that a 25-year, $150,000 mortgage at 1.74% costs $617 per month to finance. So over the next five years, I have near-guaranteed cash flow of $620.50 per month. Each month I can use this amount to pay down my mortgage of $617 per month, which is also locked in for the next five years.

So taking out this TFSA loan most likely won’t cost me a penny of my own money over the next five years.

OK. But you might be thinking: “that sounds pretty stupid Martin. You’re taking on a risky investment in order to try and make $3.50 per month”.

While this may seem intuitively correct, it’s actually wrong. Very wrong. I’m not making $3.50 per month. I’m making much, much more.

Remember, this $150,000 loan is part of my mortgage. Just like any other mortgage payment the $617 that I pay every month is composed of two parts: (i) interest, and (ii) principal. The reason your mortgage gets smaller every month is because you pay down principal. That’s why after 25 years you no longer have a mortgage and you own your home outright.

The exact same concept applies to this investment loan.

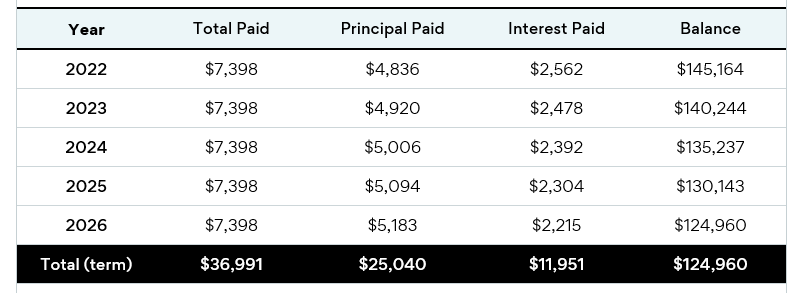

Returning to the mortgage calculator, go to the drop down menu entitled “amortization schedule” and you will see the following annual repayment schedule:

Let’s unpack these numbers:

As you can see, I’ll pay a total of $36,991 over the next five years (aka 60 months at $617 per month) on my investment loan. Of that amount $11,951 or 32% is composed of interest payments. The other 68% or $25,040 is composed of principal repayments. The net result is that in five years I will owe only $124,960 on my investment loan. Put differently, each month roughly $420 of my $617 “mortgage” payment goes towards paying down my $150,000 investment loan. Only $197 is used to pay interest. That means that every month my family gets “richer” by approximately $420.

Remember, I won’t need to sell a single share or spend a single dollar of my own money. This will be entirely funded by the monthly dividend payments from XEI. Indeed, this investment should generate average, positive monthly cash flow of roughly $3.50 per month.

If the value of these XEI shares remain unchanged over the next five years - i.e. they are still trading at $20.50 five years from now, then I will be “up” $25,040. How? Because I will still own a $150,000 investment (7,300 shares that are each worth $20.50) but I will owe only $124,960 in debt against the investment.

In summary, I’m richer by $25,000 and it cost me nothing.

The Hidden Benefit: Extra TFSA Contribution Room

But there’s more. There’s a hidden benefit associated with this investment that very few people turn their mind to.

As mentioned, given our current cash flow situation, my wife and I would have struggled to save the $6,000 each in new TFSA contribution room that we get from the government each year. We definitely wouldn’t be able to recontribute any of the $150,000 we withdrew to buy our home.

So, if we didn’t take out this loan and didn’t add any money to our TFSA’s, in five years we’d have a TFSA with $0 and $210,000 in available TFSA contribution room. This $210,000 in available TFSA contribution room is calculated as the $150,000 we withdrew to buy our home plus $60,000 in new space from the government ($6,000 per year * 5 years * 2 people). The total value of our TFSA holdings ($0) plus our TFSA contribution room ($210,000) will be $210,000.

In contrast, having taken this loan, in five years time we will have $150,000 in investments (assuming no change in the price of XEI). We will also have the $60,000 in TFSA contribution room from the government. But, we are also withdrawing a total of $7,500 from our TFSA’s each year to pay down the loan on our investment. These withdrawals can then be re-contributed in future years. The net result is that over the next five years, this investment loan will also create an extra $37,500 in TFSA contribution room that we otherwise would not have created.

Put differently, in five years we will have a TFSA valued at roughly $150,000 and available TFSA contribution of room of $97,500; calculated as $60,000 in new government space plus the $37,500 withdrawn. Our total TFSA holdings plus available contribution space will be $247,500 versus $210,000 if we didn’t take out this loan.

I can’t highlight enough how important this extra space is. While I don’t have the money to top up our TFSA’s today, my hope and expectation is that in the future I will. These TFSA’s, in turn, will hold investments that will never be taxed again. I would way rather have $247,500 of non-taxable investments than $210,000. Especially, if the process of generating that extra TFSA contribution room made my family richer and cost us nothing.

But what if the Market Crashes? Doesn’t Your Genius Scheme Fall Apart?

As you can see, I’ve assumed that my XEI shares are worth the exact same ($20.50) in five years as on the day I bought them. But will XEI trade at $20.50 in five years?

The answer, of course, is that nobody knows. It would be one hell of a fluke if the price was exactly $20.50 on the day my mortgage term expires in five years.

Markets go up and markets go down. There is plenty of volatility in the short-to-mid term. Any student of the market knows this. Even non-students of the market should know this after seeing what just happened in 2020. To illustrate, on March 23, 2020 when the market troughed following the COVID-crash, XEI’s share price closed at $12.66. On March 12, 2021, a little under a year later, it closed at $22.37. In the intervening year it obviously went up. But it didn’t go up in a straight line. It moved up, then down, then up then down, but the upwards moves exceeded the downward moves.

Over the long-run this is how markets have worked going back to the creation of stock markets. Given a long enough time horizon markets have gone up. But never in a straight line. There’s lots of volatility. There are periods of stagnation, rapid price appreciation (like we’ve seen since March 23, 2020) and harrowing crashes (like we saw from February 22, 2020 to March 23, 2020). But the data is clear. If you have broad exposure to the market for an extended period of time your investments have gone up.

From a market value perspective the “break-even” point on this XEI investment is a share price of $17.12 in five years. At this price my 7,300 would be worth $124,976 or roughly the same amount as the remaining amount on my original investment loan. This translates to a roughly 16.5% price drop. If, when I renew my mortgage, the shares are trading at anything above that then I’ve made money on my investment or am “in the money”. If it’s below that, then I’m “out of the money”.

But the bigger point is who cares what the shares are trading at on some random date that my mortgage matures in 2026? Regardless of what the price is on that one day there is no obligation for me to sell my XEI shares. And why would I sell if the shares continue to generate cash flow that exceeds the cost of my mortgage?

In five years, I will simply refinance and do the whole thing over again for another five years. My monthly dividend payments from XEI will once again cover my mortgage expenses.

Assuming, my mortgage is renewed at 1.74% then in 10 years time I will owe only $97,655 on my $150,000 loan and I’ll own the other $52,345. In 25 years I’ll own my XEI investment outright. If that’s sounds a lot like a mortgage on a home, that’s because it’s exactly like a morgage on a home.

This all Sounds too Good to Be True?

It’s not too good to be true but it is too good to last. Why? Because the ability to pull this off in a cash neutral way depends on the spread between mortage rates and the dividend yield on my portfolio.

When I implemented this several months ago the five-year, fixed mortgage rates were 1.74% and XEI was yielding 5.00%, for a 3.26% spread. The bigger the spread the more money you’ll make. Conversely, the lower the spread, the less money you’ll make.

Today, the five-year, fixed mortgage rate is 1.89%. Also, since I bought XEI the share price has increased from $20.50 to $22.50. It is now yielding 4.53% and not 5.00% (when share prices go up and the dividend remains unchanged, the yield goes down).

So today the spread is 2.64%.

Based on today’s mortgage rates of 1.89% my monthly mortgage would be $627 per month (not the $617 I pay with my 1.74% rate) and at $22.50 I’d only be able to buy 6,666 shares of XEI with my $150,000 investment loan (not 7,300). These 6,666 shares would generate only $567 per month. So instead of being cash flow positive by $3.50 per month, I’d have to dip into my own pocket to the tune of $60 per month to finance this investment. It would still be worth it but it is less attractive than it was just a month or so ago.

If being cash-flow positive is super important to you, then one thing you can do is amortize your mortgage over 30 years. Then your monthly costs on a 1.89% mortgage of $150,000 is $546, which compares to the $567 per month generated by XEI. But in five years you’ll not have paid down $25,000 on your loan. You’ll only have paid down $19,500. You’ll still be better off, but by less than you would be with a lower mortgage rate and a higher yield.

This Still Doesn’t Seem Quite Right

I get this sentiment and it’s the correct sentiment if you are thinking short-term. But over the longer term (five years plus) the risk goes down. With each additional year you hold the investment your risk goes down as you are better able to recover from any market shocks. At least this has proved to be true over a hundred plus years of stock market history.

Could this time be different? Yes, it could be. But I’m banking it won’t be. On a risk-adjusted basis this seems like a very sensible thing to do.

Another potential risk is that interest rates will increase so that when it comes time to renew my mortgage in five years that the cash flow from XEI won’t cover my monthly mortgage costs. I fully expect that when I renew my mortgage in five years the rate will be higher than 1.74%.

I’m not worried about renewing at a higher rate for two reasons. First, I expect the dividend paid by XEI to increase over the next 5 years, at least in line with my extra mortgage expense (probably more). Second, if I truly find myself in a pinch in five years then I can refinance the mortgage and extend the amortization period. To illustrate, I don’t need to amortize the balance of my mortgage over 20 years. I can renew with a 25 or 30 year amortization period, if need be (although, this will extend the period of time it takes to pay off my home).

A Little Bit About Dividends

While I’m planning on my XEI investment paying me $620.50 per month, on average, over the next five years my expectation is that the monthly payout in 2026 will actually be meaningfully more than $620.50 per month. This is based on the history of the top holdings in XEI of increasing their dividends.

XEI dropped from $23.32 on February 20, 2020 to $12.66 or by $10.66, representing a 46% decline. But what happened to the dividends? The answer is nothing. Most dividend-paying companies pay out only a portion of their cash-flow in the form of dividends. By doing so, they can absorb pretty significant shocks to the broader economy and to their share price. Since they can absorb these shocks, when these shocks do occur (and they will occur) they don’t need to cut their dividends. Once a dividend is set the company is unlikely to lower the dividend unless it is absolultely necessary. In other words, while the share price might be incredibly volatile, the dividend paid typically remains stable. In fact it typically grows.

To illustrate, let’s take a look at the top 15 holdings in XEI:

TD Bank

RBC

Bank of Nova Scotia

Canadian Natural Resources

Enbridge

BCE Inc.

Suncor Energy Inc

Nutrien

TC Energy

Telus

Pembina Pipeline

BMO

Fortis Inc

Restaurant Brands

CIBC

These 15 holdings represent 65% of all holdings in XEI. The other 55 holdings account for only 35% of XEI’s holdings. So whatever happens to these 15 stocks will disproportianately impact both XEI’s price and its dividend.

Between COVID starting and March 12, 2021 (one year later) only one of these companies, Suncor, reduced its dividend. In June 2020, Suncor reduced its dividend by a whopping 55% from $0.465 per share, per quarter to $0.21 per share, per quarter. Notably, it did not eliminate it’s dividend. It reduced it. When companies cut dividends they usually reduce rather than eliminate the dividend.

In contrast since March 2020, when the COVID-crash was at its most extreme, each of Canadian Natural Resources, BCE, Telus and Fortis increased their dividend. If you go back to January 1, 2020 (a couple months pre-COVID) nearly every company on this list increased their dividend, some have increased their dividend twice!

I expect this pattern of regular dividend increases to continue over the next five years. In other words, in five years’ time it is likely that my XEI investment will be paying out more than $620.50 per month and a good chance it will be paying out substantially more.

To illustrate, lets compare the dividends per share paid in 2016 (five years ago) versus 2021 for a sampling of the companies above. I chose the largest holding from each industry:

TD: April 2016 dividend of $0.55 per share, April 2021 dividend of $0.79 per share

Canadian Natural: March 2016 = $0.23 per share, March 19, 2021 = $0.47 per share

Enbridge: February 2016 = $0.53 per share, February 2021 = $0.835 per share

BCE: March 2016 = $0.6825 per share, March 2021 = $0.875 per share

Fortis: February 2016 = $0.375 per share, February 2021 = $0.5050 per share

All of the top 15 holdings in XEI demonstrate pretty much the same pattern of increasing their dividends. Even our dividend-cutter, Suncor, doesn’t look so bad over a five-year period. In March 2016 it was paying a quarterly dividend of $0.29 per share. That compares to today’s rate of $0.21 per share, after the big cut in June 2021.

Lingering Doubts?

So there you have it. That’s my plan. I expect to create equity, spend no money, and generate extra TFSA contribution room. I note, my “investment” is already up by $14,600 since my 7,300 shares of XEI have gone up by $2.00 per share. But I ignore this change. This is just noise and I have no doubt that at one point over the next five years the shares will trade below the $20.50 that I purchased them for. But I couldn’t care less if that happens.

Could this all backfire in my face? Of course it could. But on a risk-adjusted basis this makes sense for me. I consider the chance of coming out negative in five years time to be remote (although clearly possible). If that happens though, I have a back-up plan for how to deal with it (i.e. extending my amortization period upon renewal), absorbing any negative cash flow from my income, or in the worst case selling my shares.

The longer my investment horizon the more confident I am that this will end positively.

Sign up for my NEWSLETTER HERE